New + updated

The 12 Best Snowboard Brands of 2024

March 4th

Being a mom often means juggling a multitude of responsibilities, from managing the household to taking care of the kids, all while trying to keep the budget in check.

Carrot has created a guide designed to morph you into a money-saving mom. From clever budgeting strategies to creative ways of cutting down on expenses, this resource aims to empower you in making smart financial choices, leaving you with more room to breathe and enjoy those precious moments with your loved ones.

So, read on!

1. Meal planning and shopping list

Source: Pexels

Planning your meals beforehand not only stops you from making those “oops” buys but also keeps you on track with your shopping list, which means no more random splurges. Plus, having your pantry stocked means you’re less likely to give in to the temptation of ordering in or hitting up the nearest restaurant. It’s also a great way to use up all those groceries efficiently, so you’re not tossing out cash with the leftovers. No more impulse buying!

Related: 6 Cheap Online Grocery Shopping Stores To Help You Save Money and Live Healthier in 2022

2. Coupon and loyalty programs

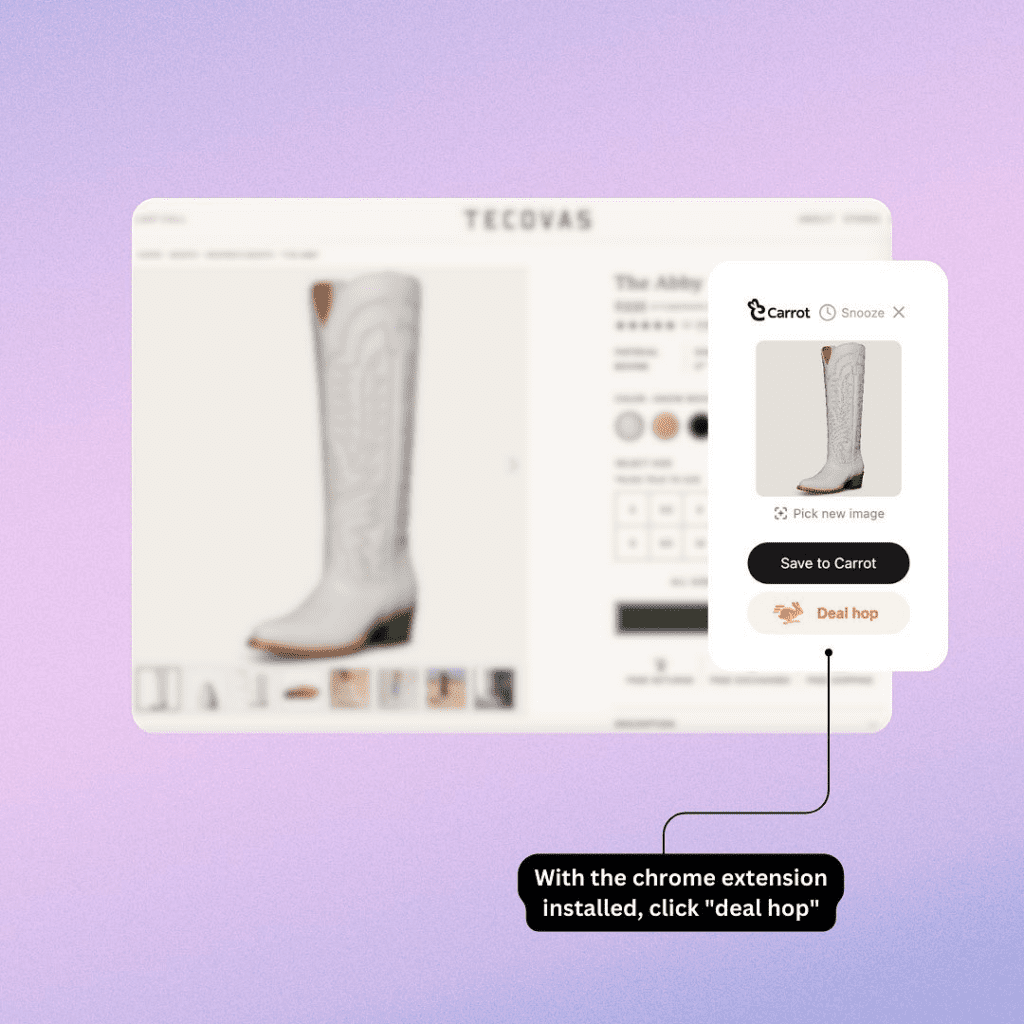

Source: Carrot

Using coupons and taking advantage of store loyalty programs can lead to significant savings on groceries and other household items. Additionally, cashback offers from certain programs or credit cards can provide additional benefits.

You’re in for a treat! We’ve got this awesome tool that hunts down all the sneaky coupons out there, so you can save big on your grocery hauls and household must-haves. Oh, and it gets even better! Our deal hop feature scours the market for the juiciest deals, making sure you snag the best bargains in town. It’s like having a savvy shopping buddy, but way cooler and always ready to score you some sweet savings!

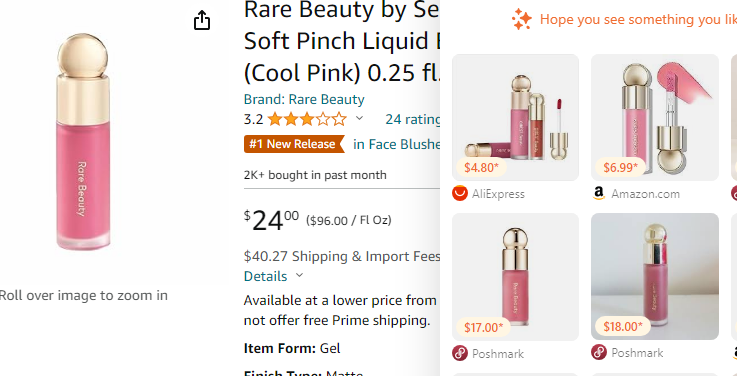

3. Generic brands

Source: Amazon

Opting for generic or store brands for products where the brand name doesn’t significantly affect quality can lead to substantial savings on your grocery bill without sacrificing much in terms of product quality.

If you’re looking to rock that luxurious vibe without breaking the bank, look no further. Carrot’s got your back! We’ll hook you up with the top dupes in the market, so you can enjoy that high-end feel without the hefty price tag.

4. Second-hand items

Source: Pexels

Purchasing gently used items for children, such as clothing, toys, and books, through consignment stores, online marketplaces, or community sales can offer substantial savings compared to buying new items.

For example, you could keep an eye out for Apple’s latest local releases and grab the previous generation model, lightly used for just a year. This way, you’ll get your hands on top-notch quality without splurging the big bucks.

Related: 8 Best Online Thrift Stores For Eco-Conscious Shoppers 2022

5. Low-cost activities for children

Source: Pexels

Exploring free or low-cost activities for children, such as community events, local library programs, and parks, can help minimize entertainment expenses while still providing enjoyable and enriching experiences.

You could get an inflatable pool, a swim set, or even a trampoline for your backyard. It’s a long-term investment that only requires occasional maintenance, giving you and your family a fun-filled haven right at your doorstep.

6. Energy-efficient habits

Implementing energy-efficient practices at home, such as using energy-saving appliances, turning off lights and electronics when not in use, and properly insulating the house, can result in reduced utility bills over time. You can unplug electronics when not in use. It helps reduce electricity consumption and consequently lowers the overall utility bill.

Ensure that you also create a routine that your kids will adapt so that energy efficiency is practiced even in your absence.

7. Budgeting for major expenses

Source: Pexels

Planning and budgeting for big expenses, like school fees or family vacations in advance allows you to spread out the costs over time and avoid last-minute financial strains. Additionally, it helps you avoid resorting to expensive credit options.

Planning ahead not only saves you from freaking out at the last minute but also means you’ve always got a special spot for all your must-have stuff. It’s like your secret weapon against chaos, keeping things cool and collected in your world!

8. DIY projects

Source: Pexels

Taking on do-it-yourself (DIY) projects for home decor, repairs, and even gifts can help save money on hiring professionals or purchasing costly pre-made items. Many DIY projects are easily accessible with online tutorials and can be a fun and rewarding way to save money.

Things like making your own cleaning solutions using simple ingredients like vinegar, baking soda, and lemon can be cost-effective.

You will also be able to perform regular maintenance on household appliances. This can extend their lifespan and prevent costly repairs or replacements

Also, this is an added skill into your pockets that you can use to make yourself some money!

Also Read: 7 Comparison Shopping Tips To Get The Best Bang For Your Buck

9. Reusable items

Investing in reusable items, such as cloth diapers, refillable water bottles, and containers, helps you avoid continuous spending on disposable products, contributing to both cost savings and environmental sustainability.

For example, when purchasing makeup brushes, be sure to choose ones that are washable and reusable for when they inevitably need a good cleaning.

10. Savings plan and automation

Setting up a specific savings plan or automatic transfer to a savings account ensures that you consistently set aside funds for future needs or emergencies, helping you build a financial safety net over time.

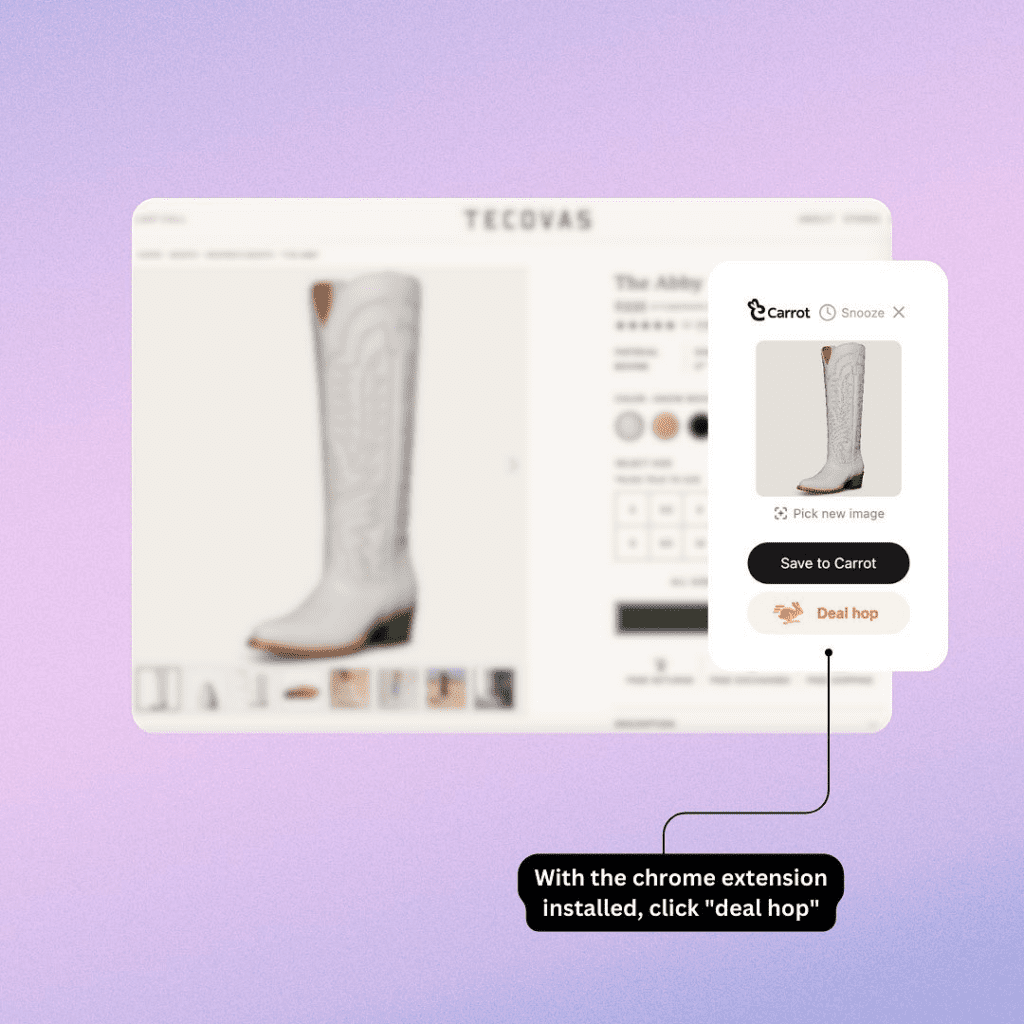

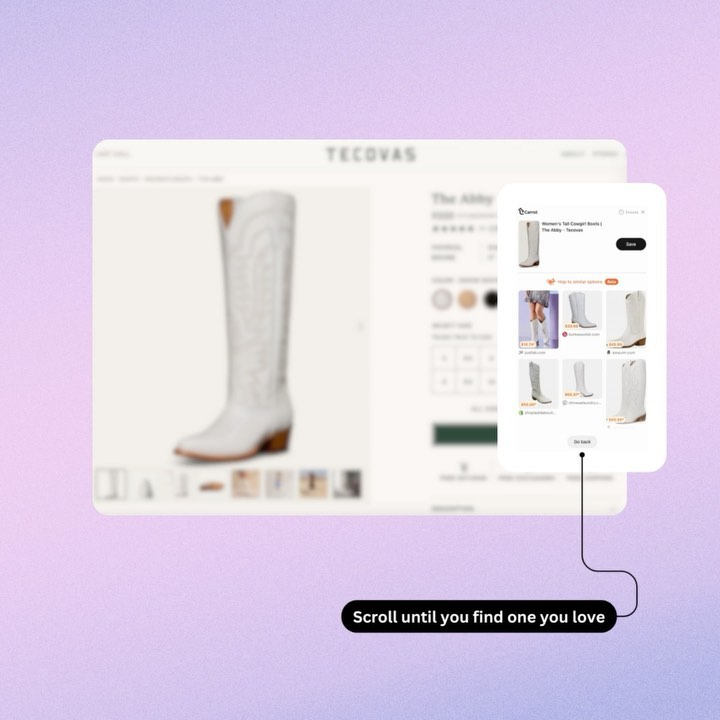

Carrot is one of the must-have tools for moms looking to save some cash while shopping online. Thanks to Carrot, moms can seriously cut their spending without breaking a sweat. One sweet deal is its price tracking feature, which lets you keep tabs on how much those must-have items are actually costing.

And don’t forget the “Deal Hop” – It’s like your secret weapon for finding budget-friendly alternatives and dupes. With Carrot by your side, you’ll be shopping like a pro and keeping your wallet happy in no time.

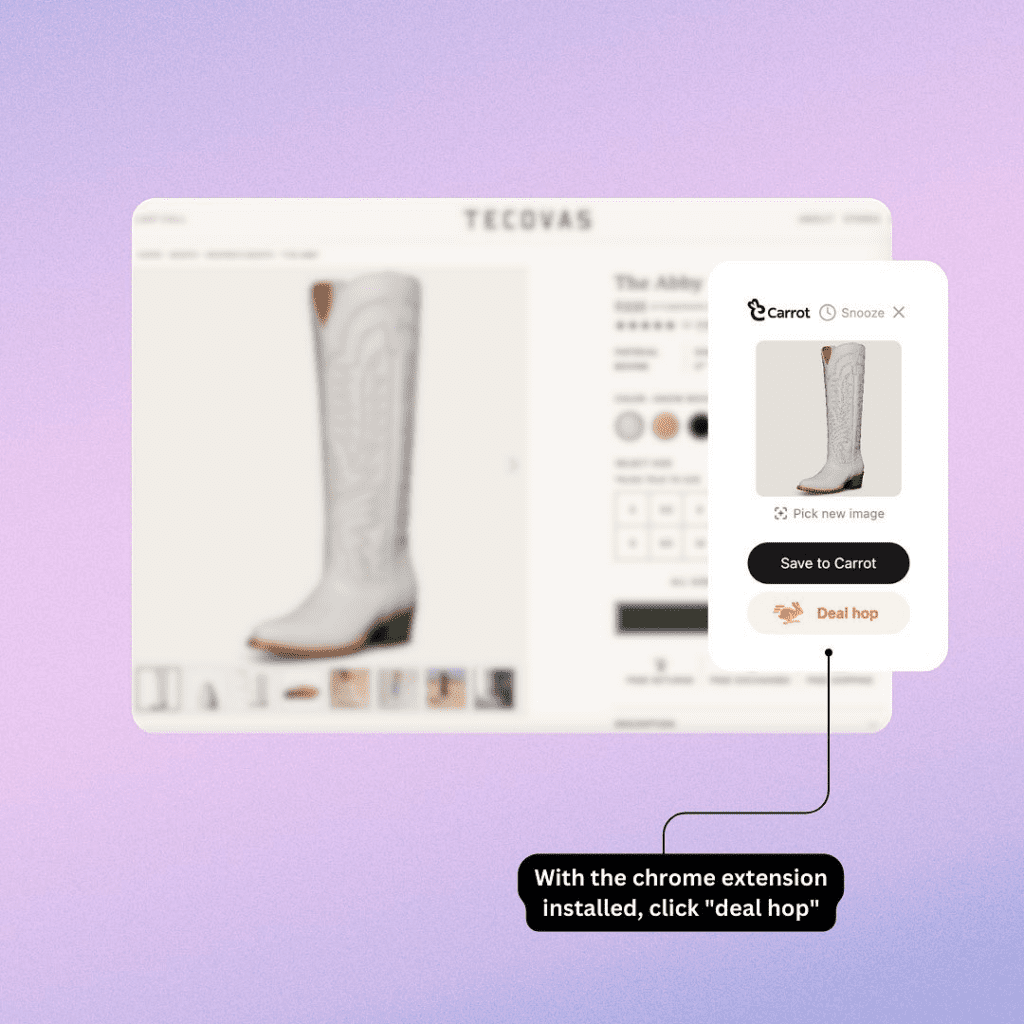

To Deal Hop, ensure that you have Carrot’s extension on your browser. Shop normally, and Carrot will pop up on your screen.

Source: Carrot’s Instagram

Then, click on “Deal Hop” for amazing deals that will help you save incredibly!

Source: Carrot’s Instagram

12. Bulk buying non-perishable items

Stocking up on things like toiletries, cleaning goodies, and dry goods in bulk can really work wonders for your wallet. It’s like hitting the jackpot of savings! Plus, you’ll never have to worry about running out of the essentials when you’ve got a stash that could last you ages.

Don’t overlook the importance of self-care. It can be as simple as treating yourself to budget-friendly makeup for those enjoyable outings with friends. So buy a couple and store them for when needed.

13. Clothing swaps or exchanges

Participating in clothing swaps or exchanges with friends or within local communities allows you to refresh your wardrobe without spending money on new clothes.

Clothes Swapping can also be done amongst your kids. Toys, books, and other fun accessories older kids use can also be passed down.

14. Plant a home garden

Source: Pixabay

Growing your own fruits, vegetables, and herbs at home can reduce your grocery bill and provide you with fresh produce throughout the year.

This also improves the aesthetics of your home. It’s also a way of spending some time with your kids while teaching them a useful skill.

Related: 7 Golden Rules to Organize Your Kitchen Pantry Without Losing Your Sanity!

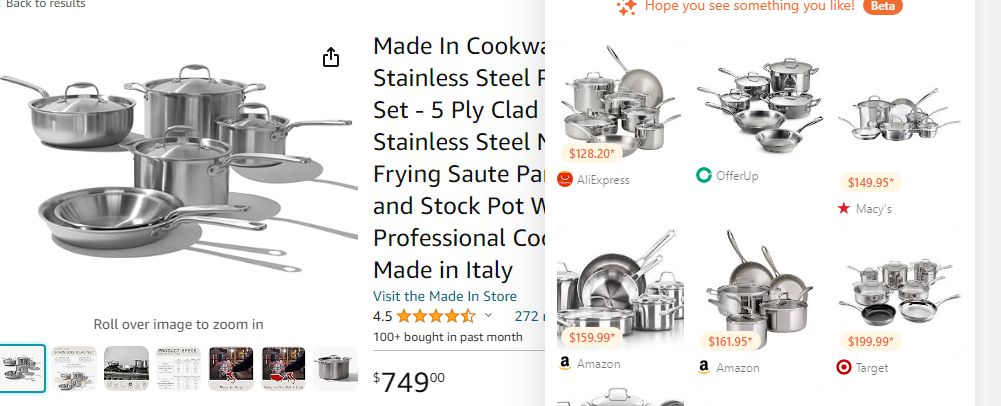

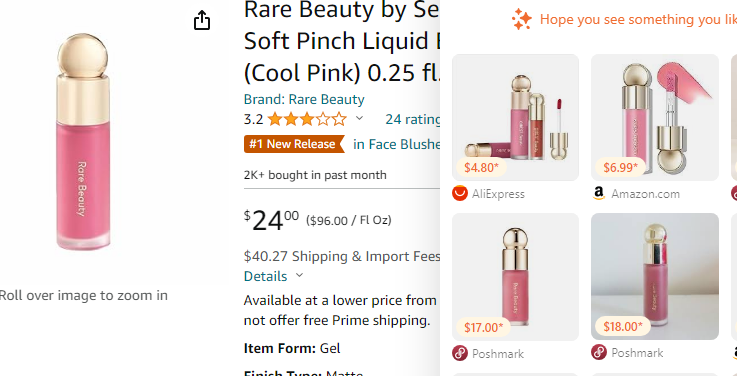

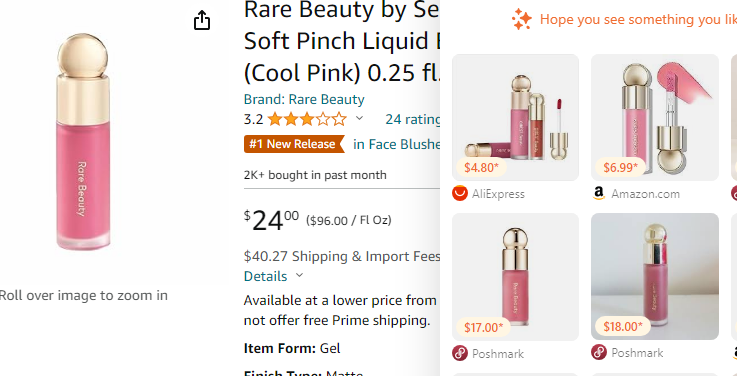

15. Comparison shopping for services

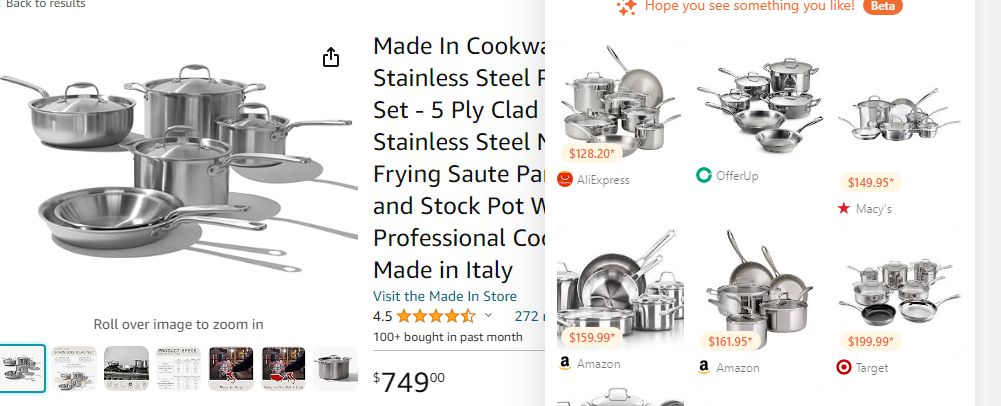

Source: Amazon

Before committing to services such as insurance, internet, or phone plans, compare different providers to find the most cost-effective options that meet your needs.

To make this easier for you, Carrot has a feature exactly designed for this. Just add it as a Chrome extension and deal hop your findings for better deals.

16. Avoid impulse buying

As a money-saving mom, when shopping, especially online, try to avoid impulse purchases. You can add what you like to your Carrot’s wishlist collection and revisit them later to ensure they are necessary and fit within your budget. Don’t forget to check out the foundation deals available on Carrot. Save them and come back to purchase them later when you’re ready!

17. Encourage saving habits in children

Source: Pixabay

Teaching children the value of money and the importance of saving can instill good financial habits early on. It will also lead to more mindful spending and saving as they grow older.

18. Invest

Source: Pixabay

Investing some of your savings, even if it’s a small amount, can pave the way for a more secure financial future. Whether it’s through a low-risk savings account, a retirement plan, or exploring the stock market, putting your money into various investment options can help it grow over time. It’s like planting seeds for a money tree that could flourish and provide for you and your family down the line.

Also Read: How To Spot Fake Product Reviews?

Conclusion

So there you have it! By putting these nifty money-saving tricks into action, you’ll be the ultimate money-saving mom. It’s the little things that add up to big savings, so keep hustling with that budgeting magic, clever shopping hacks, and maybe even a little investing mojo.

Remember, if you want to save more, Carrot should be your shopping best friend. Add it to your Chrome or Safari extension, and you’re good to go. Here’s to a wallet-friendly future and more cash for the fun stuff!